You may have seen the headlines in the media of price increases for energy costs across the UK market, and it seems as though the market has no intention of slowing down.

We are responsible for over 1,600 gas and electric meters across estates we manage. The energy rates impact many types of consumers from home occupiers, to commercial occupiers and supplies to shared areas within residential developments.

We have been working with our energy broker to monitor the market closely ensuring we renew at the optimal time. With prices rising on a daily basis this has proven to be more challenging than usual – see below some of the factors impacting the UK market and our approach to procurement.

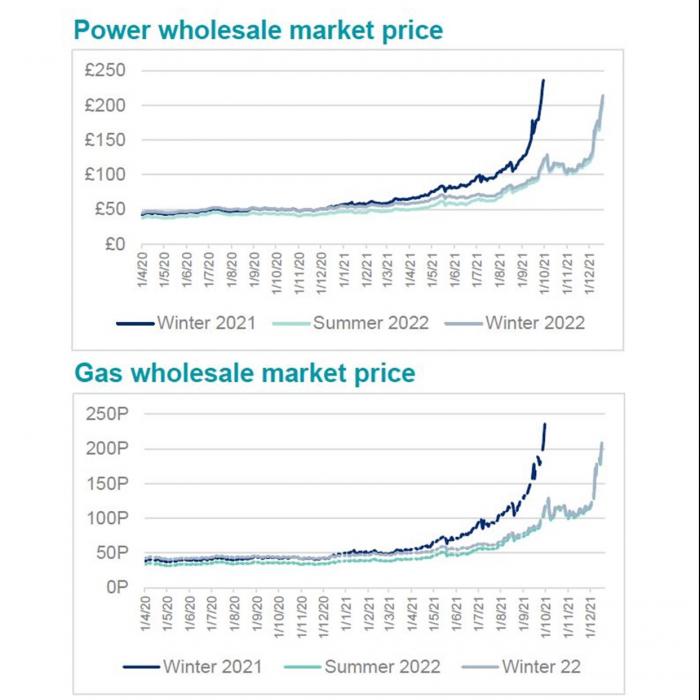

The cost to consumers reflects the energy wholesale market which reached a record high in 2021. The impact of this is set to continue throughout 2022. To put the increase into context, the market is experiencing gas prices up by 350% and electricity prices up by 85% compared to December 2020.

The UK generates around a third of its own electricity from natural gas, and as such, gas and electricity prices are strongly linked. One reason for the increased prices relates to low storage levels of gas following a prolonged cold winter across Europe. This put pressure on available gas supplies which were at a record low at the end of winter 2020. Added to that were low wind levels during the summer of 2021. This meant that gas which would typically be generated in the summer and stored for the winter was being used to fuel power stations instead. Markets were then competing to replenish gas storage levels, putting significant upward pressure on prices to ensure storage was full for winter 2021.

The UK is also heavily reliant on overseas importation of gas, meaning we are exposed to global energy demand and pricing. There have been several supply issues globally over the past year which have attributed to higher prices being experienced in the UK market. These include:

Since 2021, over 22 energy suppliers have collapsed – by entering the Supplier of Last Resort (SoLR) scheme. Other energy suppliers have been putting up prices to consumers to ensure they remain in business.

We’ve also seen a number of energy suppliers cancel contracts with a future start date or increased the prices even for fixed agreements. Many suppliers will now only hold prices for minutes rather than days, underlining the volatile nature of the market.

In residential management we typically need to procure electricity or gas for communal supplies which serve the development we are responsible for.

This may include supplies to provide electricity to communal hallway lighting, electrical apparatus such as lifts, entry phone systems (doors), fire and smoke alarms systems, emergency lighting or generators. This can also extend to un-adopted estates where we are responsible for street lighting, access gates or rain water surface pumps.

In some developments we may need to procure gas supply typically where there is a form of communal heating system serving the communal hallways and residents’ facilities.

As mentioned earlier, we are responsible for over 1,600 meters across the developments we manage. Due to our portfolio size we are able to leverage our buying power within the market and we work with our appointed energy broker to tender all contracts annually, obtaining quotes from at least three suppliers to secure the best possible rates over a 12-month period.

Our position, despite the volatile market, has enabled us to secure fixed rates, albeit increasing from previous years, which are on average 130% less on gas and 103% less on electricity compared with today’s current market rates, directly benefiting our developments and in turn our residents.

Prices and fixed contract terms are changing at an exponential rate, and in some cases are not being offered at all. Working with an energy broker has enabled us to be in a position to monitor the market and secure the best rates, whilst also providing information to our residents and clients on the challenging market and how this will impact them.

It’s also worth mentioning that the residential price cap you may hear about in the news only applies to domestic households, it doesn’t apply to the metered supply to communal areas.

Due to the unpredictability of the market, it is impossible to predict with any certainty what is going to happen and whether we will see any reduction in rates. Currently, the industry is forecasting that rates will remain high for several months, possibly even the next 1-2 years.

The current situation has highlighted the requirement for more clean energy sources being available in the UK which will provide additional resource and support to the market. Various energy suppliers are looking into investment of providing low carbon solutions however there is no timeline as to when this will be readily available or what the financial impacts to the market rates will be.

Energy suppliers are also working with the Government and Ofgem to help resolve the issues currently facing Britain’s energy system and remains ongoing.

We continue to work with our energy broker and suppliers to understand the market and how this can impact on costs going forward.